Bodla, Agra, Uttar Pradesh

Unsecured corporate loans are financial instruments that do not require collateral, relying solely on the borrower's creditworthiness and financial standing. These loans provide businesses with funding flexibility, as they do not require the pledging of assets. However, due to the higher risk for lenders, interest rates on unsecured corporate loans may be comparatively higher. Borrowers should carefully assess their financial position and repayment capacity before opting for these loans, as they can be a valuable resource for companies seeking quick capital without risking specific assets.

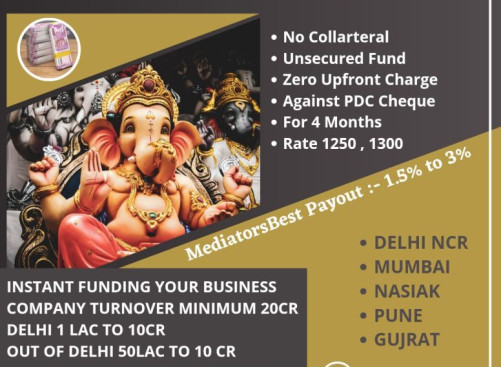

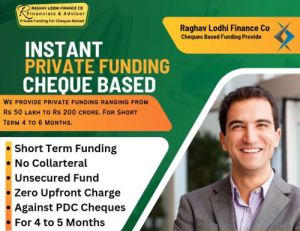

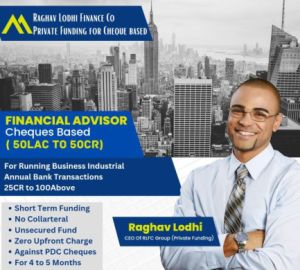

- No Collateral required

- On Turnover Basis

- Unsecured Business Loan

- Pan India

- Against PDC Cheque For Running Business

- Tenure 4-6 months

- cibil default file accepted

- Minimum turnover 20cr (Turnover in white)

- Starting funding 1cr TO 50cr

- No upfront

Looking for "Unsecured Corporate Loan Services" ?

Explore More Services